nirc lawphil|G.R. No. 210238 : Baguio Declaration of Policy. - It is hereby declared the policy of the State: (a) To enhance the progressivity of the tax system through the rationalization of the Philippine internal . Graj w Disaster Arena na najpopularniejszej stronie z Darmowe Gry Online! Poki działa na twoim telefonie, tablecie lub komputerze. Bez pobierania, bez logowania. Zagraj teraz!2020 Census of Population and Housing (2020 CPH) Population Counts Declared Official by the President (English) stated in. 2020 census of the Philippines. publication date. 7 July 2021. reference URL. . 2020 Annual Audit Report, City of Dumaguete (English) publication date. 30 June 2021.

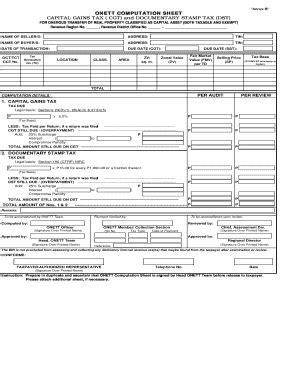

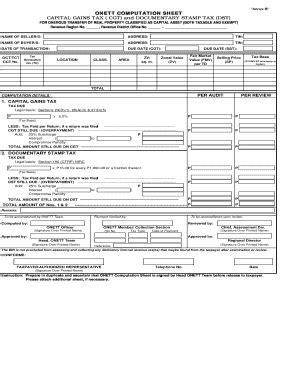

nirc lawphil,(D) Capital Gains from Sale of Real Property. - (1) In General.. - The provisions of Section 39(B) notwithstanding, a final tax of six percent (6%) based on the gross selling price or .Full text of the National Internal Revenue Code of the Philippines, also known as Republic Act No. 8424. Search by sections of the code or browse by titles and chapters.

Access the full text of the National Internal Revenue Code of 1997 (Republic Act No. 8424) published by Chan Robles & Associates. Search by titles, chapters or sections of the tax .Facts of the Case. On August 21, 2008, the Office of the City Prosecutor of Manila filed an Information against petitioner for violation of Section 255, in relation to Sections 253 (d) .Declaration of Policy. - It is hereby declared the policy of the State: (a) To enhance the progressivity of the tax system through the rationalization of the Philippine internal .

Read the full text of the National Internal Revenue Code of 1997 (NIRC 1997) with amendments and updates. Find the provisions on value-added tax, zero-rated sales, . Republic Act No. 8424. AN ACT AMENDING THE NATIONAL INTERNAL REVENUE CODE, AS AMENDED, AND FOR OTHER PURPOSES. Be it enacted by .The Facts. The respondent Bureau of Internal Revenue (BIR) issued Revenue Regulation 8-2001 or the Voluntary Assessment Program (VAP), granting tax payers the privilege of .ALINSTITUTIONS STRATEGIC TRANSFER (FIST) ACT (REPUBLIC ACT NO. 11523)RULE 1 – TITLEThis shall be known as the “Implementi. nanc. al Institutions .

Section 1. Codification of all internal revenue laws. — All internal revenue laws embodied in the present National Internal Revenue Code and various laws and presidential decrees .Begun and held in Metro Manila, on Monday, the twenty-second day of July, two thousand nineteen. [ REPUBLIC ACT NO. 11467, January 22, 2020 ] AN ACT AMENDING SECTIONS 109,141, 142, 143,144, 147, 152, 263, 263-A, 265, AND 288-A, AND ADDING A NEW SECTION 290-A TO REPUBLIC ACT NO. 8424, AS AMENDED, OTHERWISE .In view of the above findings, assessment notices together with a formal letter of demand dated August 7, 2002 were sent to LMCEC through personal service on October 1, 2002. 9 Since the company and its representatives refused to receive the said notices and demand letter, the revenue officers resorted to constructive service 10 in accordance with Section .

Avon Products Manufacturing, Inc., G.R. Nos. 201398-99 & 201418-19, October 3, 2018, 881 SCRA 451, 509. 44 SEC. 3. Cases within the jurisdiction of the Court in Divisions. – The Court in Divisions shall exercise: (a) Exclusive original over or appellate jurisdiction to review by appeal the following: x x x x.

3 CTA First Division Decision dated 23 February 2009, citing the earlier decision in St. Luke's Medical Center, Inc. v. Commissioner of Internal Revenue, CTA Case No. 6993, 21 November 2008. Rollo (G.R. No. 195909), p. 68. 4 This prompted St. Luke's to file an Amended Petition for Review on 12 December 2003 before the First Divison of the CTA.Republic Act No. 9243 February 17, 2004. AN ACT RATIONALIZING THE PROVISIONS ON THE DOCUMENTARY STAMP TAX OF THE NATIONAL INTERNAL REVENUE CODE OF 1997, AS AMENDED. AND FOR OTHER PURPOSES. Be it enacted by the Senate and House of Representatives of the Philippine Congress Assembled: SECTION 1. Section .

SUPREME COURT. Manila. SECOND DIVISION. G.R. No. 197590 November 24, 2014. BUREAU OF INTERNAL REVENUE, as represented by the COMMISSIONER OF INTERNAL REVENUE, Petitioner, vs. COURT OF APPEALS, SPOUSES ANTONIO VILLAN MANLY, and RUBY ONG MANLY, Respondents. D E C I S I O N. DEL .

[ G.R. No. 222476, May 05, 2021 ] COMMISSIONER OF INTERNAL REVENUE, PETITIONER, VS. YUMEX PHILIPPINES CORPORATION, RESPONDENT. D E C I S I O N. GESMUNDO, C.J.: Before the Court is a petition for review on certiorari filed under Rule 45 of the Rules of Court seeking the reversal of the August 11, 2015 Decision1 and .Robiegie Corporation is a Philippine corporation engaged in the business of operating a drugstore, with business address at 1614 Rizal Avenue, Sta. Cruz, Manila. 4.

Meantime, on February 8, 2019, the CIR, through the Legal Division of the BIR, 42 filed a motion for extension of time to file a petition for review 43 before this Court, docketed as G.R. No. 244155. The Petition for Review 44 was filed .

On July 8, 2011, Univation Motor Philippines, Inc. (respondent) filed its amended Annual Income Tax Return (ITR) for 2010 4 showing a total gross income of ₱117,084,174.00 and an overpayment of income taxes amounting to ₱26,103,898.52. Respondent opted to claim its overpayment of income tax through the issuance of a tax credit certificate.

Footnotes. 1 Rollo, pp. 67-106.. 2 Id. at 109-139.. 3 Id. at 140-144.. 4 BIR Form No. 2307.. 5 Rollo, p. 29. 6 CTA Case No. 8140.. 7 Section 27.C Government-owned or Controlled-Corporations, Agencies or Instrumentalities - The provisions of existing special or general laws to the contrary notwithstanding, all corporations, agencies, or instrumentalities .The Court of Appeals purportedly based its rulings on conjectures and surmises, not on established facts and law. In G.R. No. 215801, 22 the BIR et al. availed ofRu1e 45 of the Revised Rules of Court. They plead the same legal issue pertaining to which court has jurisdiction over the trial court's decision. Issues.nirc lawphilDecision 2 G.R. No. 186155 Before the Court is a Pe~ition for Review4 under Rule 45 of the Rules of Court filed by petitioner Lapariday Foods Corporation (Lapanday) seeking the reversal and setting aside ofth~ January 29, 2009 Decision5 of the Court of Tax Appeals (CTA) En Banc in C. ' T. A.The Secretary of Finance and the Commissioner of Internal Revenue 21 (Philamlife). Philamlife is a 2014 case decided by a Division of the Court, which controversy arose from an unfavorable ruling by the Secretary of Finance that affirmed, through its power of review under Section 4 of the NIRC, the CIR's denial of a request to be cleared of .G.R. No. 210238 SEC. 292. Separability clause. Search by Sections the full text of the National Internal Revenue Code of 1997 [Republic Act No. 8424, The Tax Reform Act of 1997] which took effect on January 01, 1998. Published on the World Wide by The Law Firm of Chan Robles & Associates - Philippines.

August 1, 2018. G.R. No. 206362. RHOMBUS ENERGY, INC., Petitioner. vs. COMMISSIONER OF INTERNAL REVENUE, Respondent. D E C I S I O N. BERSAMIN, J.: At issue is whether or not the taxpayer is barred by the irrevocability rule in claiming for the refund of its excess and/or unutilized creditable withholding tax. The Case.Begun and held in Metro Manila, on Monday, the twenty-seventh day of July, two thousand nine. REPUBLIC ACT N0. 9745. AN ACT PENALIZING TORTURE AND OTHER CRUEL, INHUMAN AND DEGRADING TREATMENT OR PUNISHMENT AND PRESCRIBING PENALTIES THEREFOR. Be it enacted by the Senate and House of Representatives of .nirc lawphil G.R. No. 210238 On March 29, 2010, the CIR issued a Preliminary Assessment Notice (PAN) with attached Details of Discrepancies that found respondent liable for deficiency income tax (IT) and value-added tax (VAT) in the total amount of P6,485,579.49. 7. On July 20, 2010, the CIR issued a Final Assessment Notice (FAN), assessing respondent with deficiency VAT .

nirc lawphil|G.R. No. 210238

PH0 · Republic Act No. 8424(1)

PH1 · Republic Act No. 10963

PH2 · R.A. 8424

PH3 · National Internal Revenue Code of 1977

PH4 · NATIONAL INTERNAL REVENUE CODE OF THE PHILIPPINES

PH5 · NATIONAL INTERNAL REVENUE CODE OF 1997

PH6 · IMPLEMENTINGRULESANDREGULATIONSOFFINANCIAL

PH7 · G.R. No. 253429

PH8 · G.R. No. 210238